Dec 17, 2025

How to Build a No-Code Marketing Stack for Financial Services

Averi Academy

Averi Team

8 minutes

In This Article

Build a secure, compliant no-code marketing stack for financial services that centralizes data, automates approvals, and keeps audit-ready records.

Updated:

Dec 17, 2025

Don’t Feed the Algorithm

The algorithm never sleeps, but you don’t have to feed it — Join our weekly newsletter for real insights on AI, human creativity & marketing execution.

The financial services industry faces strict regulations and complex workflows, making marketing a challenge. A no-code marketing stack simplifies this by using tools like HubSpot, Airtable, and Zapier to integrate systems, ensure compliance, and automate processes - all without writing code. This guide explains how to build and optimize such a stack to save time, reduce errors, and meet regulatory standards.

Key Takeaways:

Compliance First: Choose tools with built-in safeguards like audit trails, data encryption, and access controls to meet SEC, FINRA, or GLBA requirements.

Essential Tools: Combine a CRM (e.g., HubSpot), a database (e.g., Airtable), and automation tools (e.g., Zapier) to manage customer data, workflows, and approvals efficiently.

AI Integration: Use AI platforms like Averi for faster content creation with compliance checks built into the process.

Scalable Workflows: Automate approval chains, lead routing, and reporting to streamline operations while maintaining oversight.

Data Security: Ensure tools are SOC 2 Type II compliant and use encryption to protect sensitive information.

By adopting the right no-code platforms, you can create a centralized, secure, and efficient marketing system tailored to the financial services industry's unique demands.

Webinar: AI No Code Marketing Automation with Zapier for Payment industry professionals

Matching Your Business Needs to No-Code Tools

When it comes to financial services, two priorities stand out: compliance and efficiency. Any no-code marketing stack you choose needs to address both right from the start.

Meeting Compliance and Security Requirements

Financial services firms must navigate stringent U.S. regulations, including SEC, FINRA, and GLBA mandates. To stay compliant, your no-code tools should come equipped with enterprise-grade security features designed for high-stakes environments.

Key compliance safeguards to look for include audit trails to track every action involving customer data, role-based access controls to restrict sensitive information to authorized users, and data encryption for both in-transit and at-rest data. Many modern no-code platforms integrate these features directly into their workflows, simplifying compliance by automating what would otherwise be manual processes. When assessing tools, ensure their compliance practices are well-documented and align with regulatory standards.

Once compliance and security are addressed, the next step is ensuring your stack covers essential marketing functions.

Core Functions Your Stack Needs

A reliable marketing stack for financial services must excel in three areas: customer relationship management (CRM), workflow automation, and content creation with built-in controls. Seamless integration between these tools is vital, as it creates a unified data foundation crucial for maintaining compliance. In financial services, inconsistent or fragmented customer data can lead to regulatory risks, so integration capabilities are non-negotiable. Look for platforms offering broad connectivity - ideally with 2,000+ integrations - to link effortlessly with your existing systems, all without the need for custom coding.

AI-powered workflows can automate repetitive tasks while maintaining the oversight your industry demands. For instance, automated lead enrichment can gather prospect data in seconds, while approval workflows can route marketing materials through compliance checks before they go live. The goal is to find tools that balance automation with the controls required to meet regulatory standards.

Building Your Requirements Checklist

Start by identifying your compliance essentials: audit logging, data retention policies, user access controls, and approval workflows. Then, outline your integration needs - which systems, such as your CRM, email platform, analytics tools, and advertising networks, must connect seamlessly to your marketing stack?

Next, define your approval processes. In financial services, marketing content often requires multiple layers of review, including legal, compliance, and management sign-offs. Your no-code tools should support these multi-step workflows without requiring custom development. Finally, clarify your reporting needs. What metrics do you need to monitor? Who should have access to dashboards? How frequently will auditors require reports?

To streamline implementation, map out your current workflows and identify areas where automation can improve compliance and efficiency. This exercise will highlight gaps in your existing processes and help you prioritize which no-code tools to adopt first. Focus on platforms that provide centralized repositories for brand guidelines and company information to ensure all content remains consistent and adheres to regulations across your marketing operations.

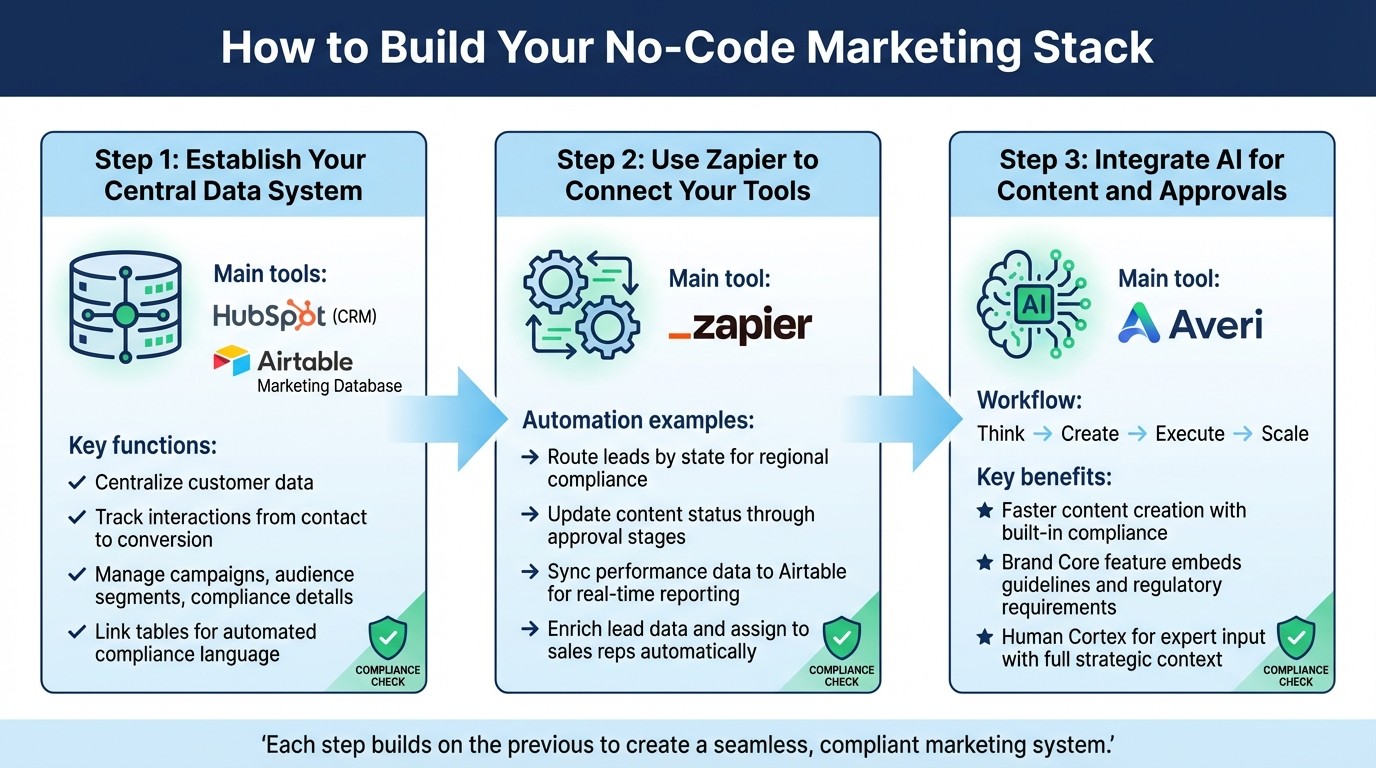

How to Build Your No-Code Marketing Stack

3-Step Process to Build a No-Code Marketing Stack for Financial Services

Once you've outlined your requirements, the next step is assembling your no-code marketing stack. The aim is to create a seamless system where data flows effortlessly, compliance is maintained, and your team can run campaigns without technical hurdles. Here's a step-by-step guide to building it.

Step 1: Establish Your Central Data System

Start by implementing a CRM like HubSpot to centralize all your customer data. HubSpot offers built-in compliance tools and integrates easily with other platforms. Your CRM will act as the hub for tracking customer interactions from the initial contact to conversion, simplifying workflows and keeping everything in one place.

Pair this with Airtable as your marketing database to manage campaigns, audience segments, and compliance-related details. Set up dedicated Airtable tables for campaign tracking, content inventory, and compliance disclosures. Airtable's customizable fields and relational database features let you link tables - such as automatically pulling the correct legal language for campaigns from your compliance table. This combination unifies your marketing efforts while ensuring compliance is thoroughly tracked.

Step 2: Use Zapier to Connect Your Tools

With your CRM and database in place, use Zapier to connect them with the rest of your tools. Zapier automates workflows by triggering actions based on specific events. For example, when a new lead is added to your CRM, a Zap can enrich the data, assign it to a sales rep based on location or interest, and schedule follow-ups - all without manual input.

You can also configure Zaps to handle tasks like:

Routing leads by state to comply with regional regulations (e.g., triggering unique workflows for California versus Texas leads).

Updating content status as materials move through approval stages.

Syncing performance data from ad platforms to Airtable for real-time reporting.

These automations reduce manual data entry and minimize the risk of errors, especially in compliance-sensitive processes.

Step 3: Integrate AI for Content and Approvals

Take your workflow to the next level with AI-powered tools. Platforms like Averi simplify content creation and approval by consolidating everything into one workspace. Instead of juggling multiple tools for brainstorming, drafting, and approvals, Averi’s streamlined process - Think → Create → Execute → Scale - mirrors the natural progression of marketing projects.

For industries like financial services, this integration allows for faster content creation with compliance baked in. Averi’s Brand Core feature embeds brand guidelines and regulatory requirements into the content creation process, ensuring every piece aligns with your standards. When expert input is needed, Averi’s Human Cortex feature enables vetted specialists to step in with full access to your strategic context and brand guidelines, eliminating the need for repeated briefings.

Setting Up Compliance, Governance, and Reporting

Once your no-code tools are connected, the next step is ensuring oversight systems are in place. These systems are essential for staying compliant with regulations, managing secure data, and tracking what’s working effectively in your financial services marketing.

Building Approval and Audit Workflows

Establishing a clear approval process is key. In Airtable, you can set up a table with status fields like "Draft", "Legal Review", "Compliance Approved", and "Published." Each marketing asset gets its own record, complete with attached files, approval dates, and reviewer details. Airtable's automation features can notify the right person when a status changes, and timestamps ensure an audit trail is maintained.

For instance, when a blog post moves to "Legal Review", an automated email can notify your compliance officer, including a link to the asset and any required disclosures. This setup ensures every approval is documented, which is crucial during regulatory reviews.

HubSpot can enhance this system by managing workflows for email campaigns and landing pages. You can create approval chains to guarantee that no customer-facing material goes live without proper authorization. Combining Airtable and HubSpot offers a dual-layer approach - Airtable handles content tracking and compliance records, while HubSpot oversees campaign execution. To further secure your operations, focus on data protection.

Protecting Customer Data

Use Zapier’s filtering tools to safeguard sensitive information during data transfers. For example, when syncing leads from HubSpot to Airtable for campaign planning, configure your Zap to only transfer necessary fields such as industry, company size, or geographic region - leaving out names, emails, or phone numbers. This minimizes the risk of exposing personally identifiable information.

Ensure every tool in your stack meets top-tier security standards, such as SOC 2 Type II compliance, and supports strong data encryption for both transit and storage. With these measures in place, you can confidently protect customer data while maintaining compliance. Next, focus on tracking how your campaigns perform.

Tracking Performance

Centralize your performance metrics in a HubSpot dashboard. Pull in data like cost per lead, conversion rates, and overall ROI from ad platforms, website analytics, and email campaigns. Set up automated weekly reports to share key metrics with stakeholders every Monday morning.

Integrate this reporting into your planning process with Zapier. For example, you can automate alerts for campaigns that hit specific benchmarks, like a 5% conversion rate or a $50 cost per acquisition. When this happens, Zapier can create a new record in Airtable to flag the campaign for deeper analysis. This approach allows you to quickly adapt and refine your strategies based on real-time performance insights.

How to Choose the Right No-Code Tools

Now that you’ve got a handle on building and securing your tech stack, it’s time to focus on picking the right no-code tools. The key is selecting options that not only streamline your operations but also align with your compliance and workflow needs.

What to Look for in No-Code Tools

When evaluating no-code tools, make sure they meet strict security and compliance standards. Look for certifications like SOC 2 Type II, GDPR, and CCPA, along with features such as built-in encryption, audit logs, and data residency.

Integration capabilities should also be a top priority. The tools you choose should work seamlessly with your CRM, compliance software, and analytics platforms. Opt for systems that support bidirectional data flows and automated updates. Avoid creating more silos - look for tools that unify your data into a single, queryable platform.

Automation is another critical factor. Choose platforms that can handle routine tasks and approval chains using conditional logic. This ensures human oversight remains intact for critical compliance checks while reducing manual effort.

Lastly, consider the total cost of ownership. Look beyond subscription fees to factor in add-ons, training, and other expenses. Aim for tools with predictable pricing models to ensure a consistent return on investment.

Side-by-Side Tool Comparison

Here’s a quick comparison of popular no-code tools, highlighting their key features and costs:

Tool | Compliance Support | Security Features | Integration Capabilities | Starting Price (USD) |

|---|---|---|---|---|

HubSpot | GDPR, CCPA | Data encryption, user authentication | 2,000+ integrations | $50/month |

Zapier | Limited compliance | User authentication, encrypted transfers | 3,000+ integrations | $19.99/month |

Airtable | GDPR compliant | Data encryption, access controls | 1,000+ integrations | $10/user/month |

Averi | Enterprise-grade practices, GDPR/CCPA-conscious | Encryption, user control, Privacy Mode | Coming soon: CMS, email, social, analytics | $45/month (Plus) |

AI Workspaces vs. Other Options

AI marketing workspaces, like Averi, offer an all-in-one solution for strategy, content creation, and execution. These platforms maintain a persistent understanding of your brand voice and compliance needs, eliminating the hassle of switching between tools. Plus, they allow for expert intervention when necessary.

Standalone tools, such as Zapier, Airtable, and HubSpot, excel at specialized tasks but require manual effort to connect and synchronize data across platforms. This can be time-consuming and may complicate compliance management.

Freelancer platforms and agencies, on the other hand, bring human expertise to the table without requiring software know-how. However, they often come with longer timelines and unpredictable costs due to varied project fees and coordination demands.

Factor | AI Workspaces | Standalone Tools | Freelancers/Agencies |

|---|---|---|---|

Speed | Drafts in seconds, real-time updates | Varies by tool; manual data transfer | Weeks to months per project |

Compliance | Built-in guardrails, secure platform | User manages compliance across tools | Requires vetting and contracts |

Cost Predictability | Fixed subscription | Multiple subscriptions plus integration costs | Project fees, hourly rates |

Context Retention | Persistent across all work | Siloed within each tool | Requires re-briefing each time |

Your choice ultimately depends on your team’s technical expertise, budget, and the level of control you want over your processes. For industries like financial services, where compliance is non-negotiable, unified platforms often prove to be the most effective option, reducing vendor complexity and the need for frequent security reviews.

Getting Started with Your Marketing Stack

Start by applying your compliance and integration strategy to your no-code tools. Pinpoint any disconnected systems that might be causing inefficiencies. Streamlining these tools into a cohesive system ensures smoother operations and aligns with the compliance and integration principles outlined earlier.

Consider using a single, unified platform that can manage content creation, inbound lead processing, and customer engagement. This eliminates the need for multiple subscriptions, reduces vendor complexity, and simplifies compliance reviews by operating within one secure environment.

Document your go-to-market processes in a detailed playbook. Include best practices, approval workflows, and compliance requirements. This groundwork ensures that automation enhances efficiency rather than amplifying existing problems.

Once your processes are clearly defined and your security measures are in place, test your integrated system with a single use case. Prioritize platforms that meet strict security standards like SOC 2 Type II certification and support GDPR and CCPA compliance. Look for tools offering extensive integrations - ideally over 2,000 - to seamlessly connect with your CRM, compliance software, and analytics tools. Robust security is critical for operations that directly impact your business.

Start with a high-impact use case, such as inbound lead processing or content creation, and measure its success before scaling further.

Jean English, Former Chief Marketing Officer at Juniper Networks, noted that adopting a personalized, AI-driven go-to-market strategy resulted in a fivefold increase in meetings [1].

With proven workflows and measurable outcomes, you'll be well-positioned to expand your marketing stack to meet broader business needs.

FAQs

How can no-code tools help financial services marketers stay compliant?

No-code tools are a game-changer for marketers in financial services, offering built-in features like data security protocols, user access controls, and audit trails to ensure compliance. These platforms are often tailored to align with industry regulations, helping marketing teams meet legal standards effortlessly.

By automating workflows and minimizing manual errors, no-code platforms simplify the handling of sensitive customer data. They enable teams to meet stringent regulatory requirements without requiring technical know-how, allowing marketers to concentrate on creating impactful campaigns while staying fully compliant.

What are the advantages of using AI in a no-code marketing stack?

Integrating AI into a no-code marketing stack can transform how your team approaches campaigns, making processes smoother and outcomes more impactful. With AI, you can produce content faster, automate time-consuming tasks, and offer personalized experiences on a large scale.

AI also delivers data-backed insights that help refine decisions, enabling you to fine-tune campaigns and workflows without needing advanced technical skills. By minimizing manual work and lowering expenses, AI allows your team to shift focus toward strategic planning and creative innovation while staying efficient.

How can I keep my data secure while using no-code platforms?

To ensure your data stays protected when using no-code platforms, start by setting up strict access controls - only grant permissions to individuals who truly need them. Encrypt your data both while it's being transmitted and when it's stored, as this adds an essential layer of protection for sensitive information. Make it a habit to regularly update the platform and install patches to fix any potential security gaps.

Take time to review the platform’s security policies to verify they meet your compliance requirements. It's also crucial to establish clear data governance rules to oversee how information is stored, accessed, and shared. By following these measures, you can better protect your data and maintain confidence while taking advantage of no-code tools.